Life Insurance in and around Louisville

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

It may make you weary to contemplate when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to the ones you hold dear.

Coverage for your loved ones' sake

Life happens. Don't wait.

Their Future Is Safe With State Farm

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less stressful. Life insurance provides financial support when it’s needed most. Coverage from State Farm provides space to grieve without worrying about expenses like car payments, your funeral costs or childcare costs. You can work with State Farm Agent Jennifer Starke to extend care for your partner with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

Don’t let fears about your future make you unsettled. Visit State Farm Agent Jennifer Starke today and discover the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call Jennifer at (502) 244-2698 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

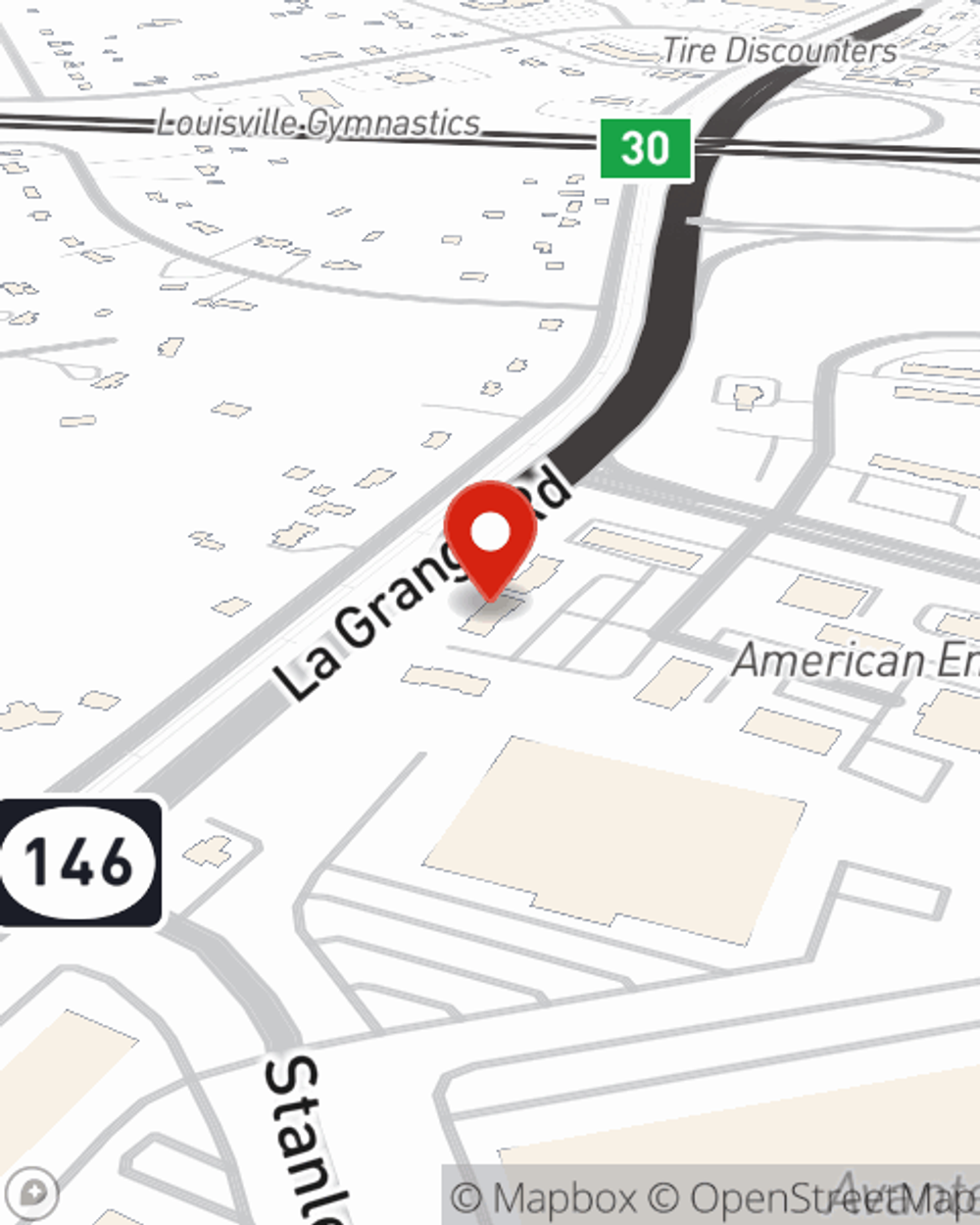

Jennifer Starke

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.